Category: budget deficit

-

Lowering the Bar on Lowering the Deficit

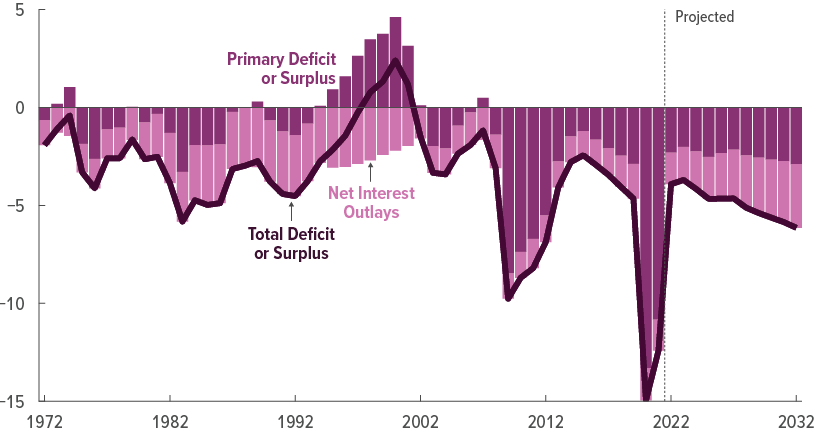

It’s a sign of how out of hand the situation is when a trillion-dollar deficit is seen as an improvement.

-

A Balanced Look at a Balanced Budget Amendment

The growing concern about America’s mounting national debt and the inability of our elected leaders to adequately address it has led to many calls for a balanced budget amendment (BBA) to the U.S. Constitution. Given our current fiscal problems, the attractiveness of requiring federal spending and revenue to balance each year is obvious and no…

-

My Declaration for the Fourth

Amid the cook-outs and fireworks this weekend, it is easy to forget the real reason we celebrate the Fourth of July. It is because 235 years ago the Continental Congress adopted a radical document stating that it was necessary for the 13 American colonies to severe their bonds to the British Empire in order for…

-

The Bulge We Should Be Worried About

All the talk about the bulge in Rep. Anthony Weiner’s pants is distracting from the real bulge we should be worried about — our bulging national debt. Without action, our debt will hit unprecedented heights. Under realistic assumptions, public debt is projected to reach over 120% of GDP by 2030 and over 180% by 2040.…

-

Vacation and Vacating

August is a relatively calm time to reflect before the stormy months ahead. Congress is currently in recess, the president is on vacation. By contrast, the period after Labor Day will be marked with shrill posturing in Washington and heated campaigning throughout the country ahead of the November election. I recently had my vacation with…

-

Friday Policy Haiku — Stimulus

Congress can’t balance/ Stimulus now, debt later/ No plan, just gridlock

-

Bring on Budgetball

The Policy Daddy cares so much about spreading the word regarding the need for responsible budget policy that he is putting his body, and pride, on the line this coming Friday. I will participate in the Budgetball on the Mall tournament on the National Mall in Washington, DC on May 21 starting at 3 pm. Budgetball…

-

Friday Policy Haiku – Deficits and Debt

Deficits and debt Hard choices delayed, denied Our children will pay

-

The New S-word

There is a particular word that the Obama Administration apparently feels is too provocative for public discourse – that word is “stimulus.” The President mentioned the word exactly once in his State of the Union address, ditto for the White House Budget, which is 192 pages. Doing one better, OMB Director Peter Orszag and Treasury…

-

Happy Budget Day

Today much of Washington stood still as many plodded through the hundreds of pages and myriad graphs, charts and tables in the White House Budget request for fiscal year 2011. It is an annual rite in Washington that the first Monday in February be spent this way. Though thanks to modern technology the materials are…