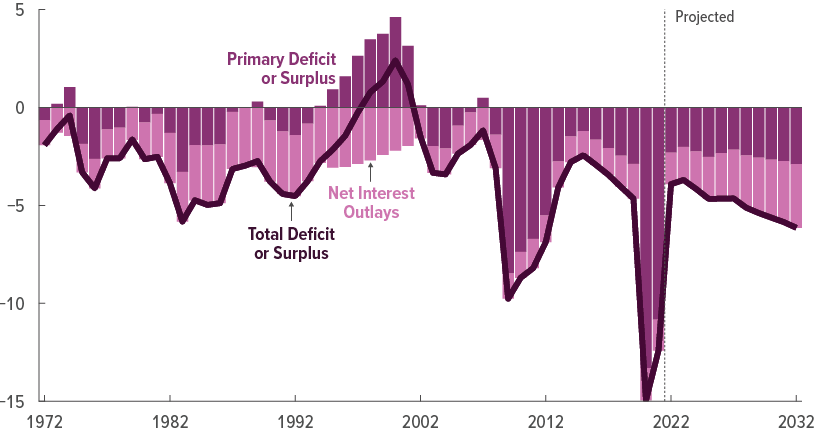

“U.S. Budget Deficit Is Projected to Fall to $1 Trillion in 2022.” That is the headline of a recent New York Times article on the latest official budget projections from the nonpartisan Congressional Budget Office (CBO). It’s a sign of how out of hand the situation is when a trillion-dollar deficit is seen as an improvement.

Yes, $1 trillion is far less than the record 2020 deficit of over $3 trillion and last year’s $2.8 trillion deficit, but it’s misleading to imply that a smaller deficit from previous years means things are getting better. The fact is the fiscal situation is worsening, it simply is not deteriorating as rapidly as before.

A budget deficit occurs when spending for the year outpaces revenue. Accumulated annual deficits result in the national debt. The debt is still growing, just at a slower pace than previously was the case.

Besides, shrinking deficits are a short-term phenomenon. The CBO forecast sees deficits growing again by 2024. The annual deficit is projected to be $2.3 trillion in ten years.

It’s true that the economy is also growing (though with bumps along the way), but even when viewed in relation to Gross Domestic Product (GDP), deficits and debt are projected to grow in the medium and long term. In fact, CBO projects debt held by the public, which excludes what the government owes itself, will exceed the size of the economy by 2027 and reach an all-time record of 110 percent of GDP by 2032.

CBO also states that the high and rising debt it foresees will have serious consequences for the U.S. economy.

A lower deficit from historical highs is nothing to celebrate. Policymakers will have a lot of work to do to address the challenges ahead.

Leave a comment